House Prices in 2022 Since the pandemic started in March 2020, we have seen some unprecedented developments within the housing market. When the market re-opened in June of the same year, the property market over the last 18 months has been described as ‘frenzied’ by Rig read more

Category: Urban Union

Laurieston Living Happy Buyers When Kayleigh Lewis’ partner Danny popped the question, they began looking for their first home together. The newly-engaged couple knew they weren’t ready to take on a house and were originally considering buying a tenement flat in the Sha read more

A Home for Christmas – For Just a £99 Reservation Fee! We have just six apartments left in this final release of properties for the current phase, at our newest Glasgow development, Pollokshaws Living. Until December 19th, these last remaining apartments ar read more

COP26 House is now open and available to view! COP26 House demonstrates how beautiful, affordable homes can help meet global climate change ambitions, will open its doors to the public for two weeks only from Monday, 1 November. The House has been built by Urban read more

Zero-carbon COP26 House opens its doors to the public

— Public invited to Beyond Zero Homes building to see how a zero carbon, circular design can be achieved with materials and skills readily available today —

COP26 House, which demonstrates how beautiful, affordable homes can help meet global climate change ambitions, will open its doors to the public for two weeks only from Monday, 1 November.

Built by Glasgow-based regeneration specialists Urban Union for the UN Climate Change Conference, the zero-carbon timber-frame building was developed by Beyond Zero Homes. Created and led by Peter Smith of Roderick James Architects, Beyond Zero Homes is a collaborative group of over 20 organisations from across the home building sector who want to show the world how affordable and desirable homes can be constructed with minimal impact on the environment, using standard materials and skills available today.

As well as having a reduced reliance on concrete and steel, the COP26 House has been built mainly using locally-sourced home-grown timber provided by the BSW Group, the UK’s largest integrated forestry business, and natural materials provided by the different organisations that make up Beyond Zero Homes.

It has been designed to store more carbon than is produced during its construction and will only require heating in the coldest times of the year due to the high levels of insulation. Heating, when required, will be provided by infra-red panels which heat objects and people directly, rather than heating the air. This low-cost electric solution is also almost entirely recyclable at the end of its lifecycle.

Unlike the materials used in standard homes today which are either incinerated or sent to landfill at the end of their life, the COP26 House has been designed so that it can be completely dismantled and recycled. This will be demonstrated after COP26 when the house will be deconstructed and rebuilt as part of a development of affordable homes near Aviemore.

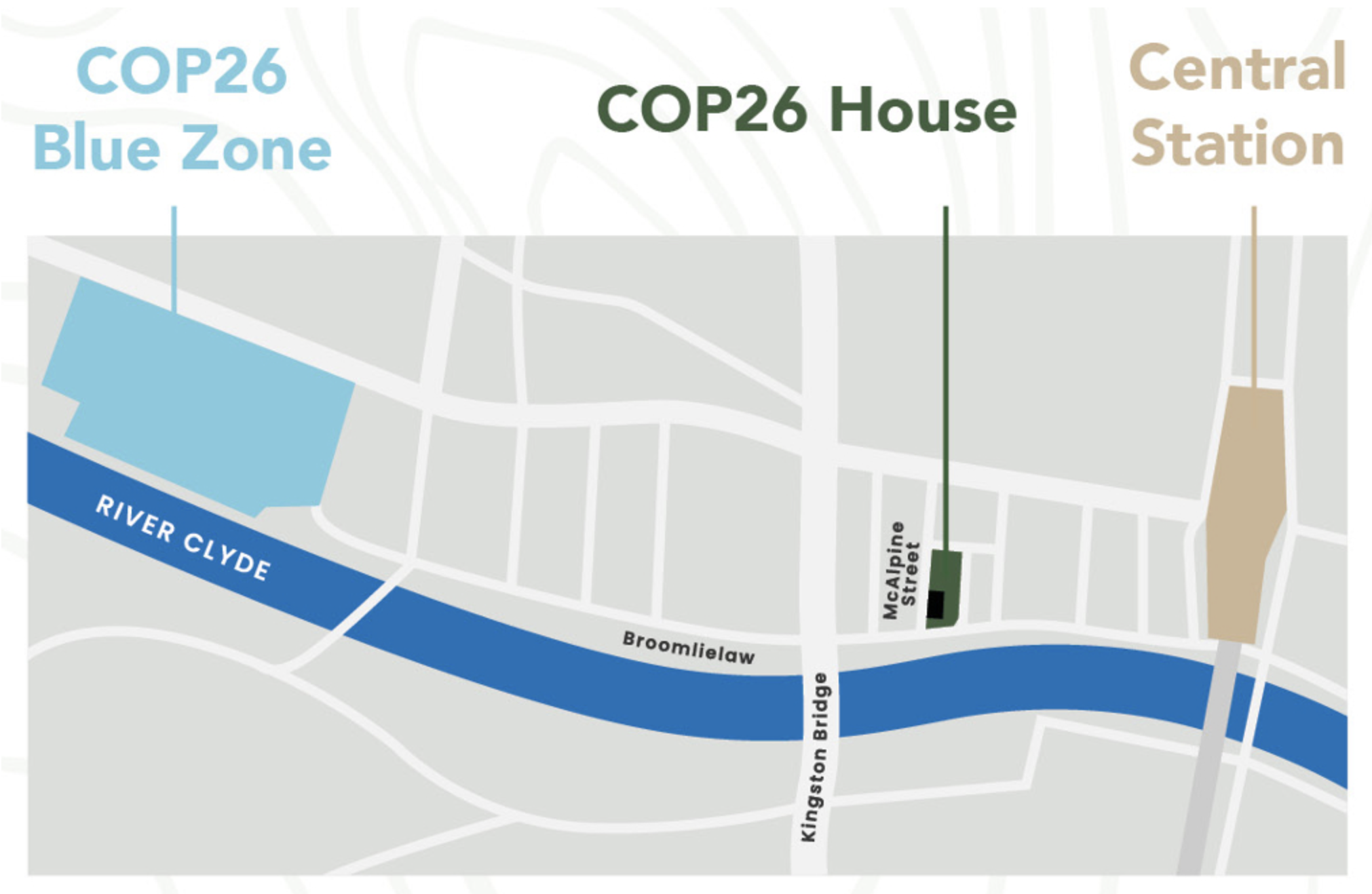

During COP26, the house will be located on the Broomielaw, just a short walk from the Scottish Event Campus. As well as hosting private events and tours for school groups, COP26 House will be open to the public at various points throughout the two-week period. More information can be found on the Sustainable Glasgow Landing website.

Peter Smith, Roderick James Architects, said: “It is vital that the houses we are building now are truly sustainable, being low carbon in construction and use. But with the COP26 house, I wanted to demonstrate that truly sustainable, ecologically responsible buildings can also be beautiful, comfortable to live in and low cost to build using locally-sourced materials.”

Pupils from a number of primary schools in Glasgow and Edinburgh have been invited for guided tours of COP26 House hosted by Urban Union. As well as learning about the materials and technologies used in construction, the school children will have the opportunity to enter a competition to design their dream home using recycled materials. Entries will be judged by representatives from Beyond Zero Homes.

Neil McKay, Managing Director of Urban Union which is part of the Robertson Group, said: “The construction industry has a central role to play in helping to reduce the world’s carbon emissions and the COP26 House demonstrates that many of the solutions needed to fight climate change already exist, we just need to put them into practice.

“Everyone wants a comfortable home and by building the COP26 House we’ve shown they can have that while protecting the environment at the same time. Together with our Beyond Zero Homes partners, we want to welcome as many people as possible to the house so they can see this for themselves. And school visits will play a part in hopefully inspiring the next generation of architects and construction workers needed to help our industry achieve its sustainability ambitions.”

Tony Hackney, CEO, from BSW Group, the UK’s largest integrated forestry business which provided home-grown UK timber for the build, said: “The COP26 House is an important milestone in the move towards mainstream use of home-grown timber in the housebuilding sector. This will reduce transport miles and carbon emissions while supporting local sawmillers and growers. The UK timber sector is worth over £10 billion to the economy, providing thousands of jobs across the country in forestry, sawmills, high-tech manufacturers, merchants, and housebuilding.”

The COP26 house is a one-bedroom unit with mezzanine studio, with an internal floor area of 70m2. The estimated guide price to build a home like this is between £1,800 per square metre for self-build and up to £2,500 per square metre, dependent on size, location, builder, and final finish specification.

The members of Beyond Zero Homes who worked together to build COP26 House include Roderick James Architects, Home Grown Homes, BSW, Robertson Group, Urban Union, MEDITE SMARTPLY, NorDan, National Timber Group, STEICO, Herschel Infrared, Fakro, Paul Heat Recovery, RothoBlaas, Ultimate Insulation, Ecomerchant, Circular Ecology, David Narro Associates, Roddy Clarke, IES, Radiator Digital, Orluna, Rainclear, Glenalmond Timber and Scottish Forestry.

Find out more about COP26 House.

My Sustainable Home Competition

To celebrate the opening of COP26 House, we’re inviting primary school pupils to design their own sustainable home using recycled materials.

Taking inspiration from COP26 House, we want to see a model of what your sustainable home could look like and hear what makes your design both special and environmentally friendly.

To create a model of your sustainable home, you could use materials such as:

- Used cardboard packaging

- Empty cans

- Toothpicks

- Corks

- Egg cartons

- Bottle caps

To be in with the chance of winning £100 worth of Smyths vouchers, please ask a parent or guardian to send the following to info@urbanunionltd.co.uk

- Full name

- Name of primary school

- Class / Name of teacher

- Photograph of your sculpture along with a short description of your design

- Please note, you must also attach a consent form signed by a parent or guardian. This can be downloaded below:

The most creative entry will be selected by a panel of judges from Urban Union & Beyond Zero Homes.

To bring this to life, the digital construction team at Robertson will transform the winning design into a rendered 3D digital model.

The competition closes on 22nd November.

Good Luck!

COMPETITION TERMS & CONDITIONS

- The parent or guardian of the entrant must apply by email as stated above

- A winner will be chosen by Urban Union and representatives from Beyond Zero Homes

- The winner will receive £100 voucher for Smyths

- The prize is non-transferable and no cash alternative will be offered.

- The competition closes at 5pm on 22nd November

- The competition is open to primary school pupils in Scotland only.

- This competition is not sponsored, endorsed or administered by Facebook or Instagram.

- The competition excludes Urban Union and Robertson Group employees and their immediate family.

- Entries are limited to one per person

- The winner will be notified within fifteen working days of the competition closing via the email

- In the event that the winner does not respond to our message informing them they have won within five working days, we reserve the right to choose a new winner.

- We reserve the right to cancel this promotion at any time.

Scotland’s Buy-to-Let Market For investors, one of the most popular investment strategies is to purchase a buy-to-let property and earn returns through rental yields over time, focusing this along with investing for the long term with capital gains. Rental yields can va read more

First time buyer?

Are you looking to purchase your first home, but don’t understand how mortgages work? According to a Bank of Scotland study carried out last month, a quarter (25%) of young Scots aged 18 to 34 said a lack of financial knowledge is a key barrier to home ownership.

The study showed that 39% of young people in Scotland were unable to confidently outline the mortgage process and that the key barriers for home ownership was affordability (73%), saving for a deposit (62%) and finding a suitable home (34%).

Half of all 18 to 34-year-olds either rent from a private landlord, while 34% rent from a private landlord, 16% life with their parents and 21% live in a mortgaged home.

A quarter of those who live with their parents are doing so by choice whilst three quarters are only at home because they have no other option and cannot afford to move out. Some young people anticipate that inheritance will help them release their home ownership ambitions but 11% believe they will never be able to afford their own home.

Younger people who plan to purchase their own home believe they will achieve this by the time they are 31 – the average first time buyer in Scotland is 30 years old according to Halifax.

The research also found that young Scots aren’t financially confident when it comes to understanding how mortgages work, and this gap in their knowledge is causing them to delay their home ownership dreams.With that in mind, here’s a brief guide to give you some tips to help you secure a mortgage.

Finding a high loan to value mortgage

Although the pandemic meant that many lenders withdrew many mortgage products, we have seen the reintroduction of some great deals with low rates making home ownership much more affordable and accessible for first time buyers. There are plenty of 90 or even 95% mortgages available but it’s essential that you can afford the repayments. Talk to a mortgage broker who can search the whole of the market to find the best deal and to explain how the application process works. You could also discuss a guarantor mortgage whereby your parents or grandparents will secure your mortgage against their home or put their money into a fixed-term account.

Mortgage Guarantee Scheme

The mortgage guarantee scheme is a 95% loan to value (LTV) mortgage scheme to help buyers with a 5% deposit. Under the scheme, buyers can purchase a property priced up to £600,000 and it is open to everyone, not just those who are buying their first home and never had a mortgage before – as was the limitation for the Help to Buy Scheme.

New build

With house prices rising since the housing market reopened at the end of June at an unprecedented rate – due to the stamp duty holiday and a re-evaluation of buyers’ priorities – buying at a fixed price means you aren’t being priced out of the market. The price you see is the price you pay with no closing dates, offers over or paying over the odds due to high competition for the same property. In addition, there are often house builders incentives such as free fixtures and fittings, stamp duty bills and legal fees.

Ensure your credit rating is in order

It’s important that you have a good credit score so that you can obtain a good rate on your mortgage – the lower the score the lower risk you are considered to be by the lender, and the deals available to you will be limited. Check your credit score before you look to buy a property to give you time to improve this.

A larger deposit

If you can gather together a larger deposit to put towards the cost of your mortgage it will keep your outgoings down and open up betresr rate mortgages. Ideally you want to have 15% deposit to get the best possible deal.

New release Pollokshaws Living

The long awaited collection of high quality one and two-bedroom apartments starting from £160,995 will be released from Thursday 16th September. Our last release sold in a matter of days, and we anticipate high demand for these homes.

Pollokshaws Living is within an easy commute of Glasgow city centre and Pollokshaws West train station is very close to the development. The M77 motorway is within a five-minute drive, as is Silverburn Shopping Centre. The development is next to a range of amenities and Pollok Park, which provides the perfect escape from city life. Nearby Shawlands has a host of bars, restaurants, independent shops, boutiques and health and sports facilities.

Looking for your first home?

Although last year saw a withdrawal of many high loan-to-value mortgages, these are now largely available once again making home ownership within many buyers’ reach once again.

At present there are plenty of 90% and 95% loan to value mortgage deals available, which means that you only need a 10% or 5% deposit in order to secure a mortgage.

Finding a high loan to value mortgage

Although most lenders withdrew their mortgage deals during the pandemic, many of them have reintroduced some fantastic deals with low rates making home ownership affordable for first time buyers. If affordability is still an issue, then you could consider a guarantor mortgage whereby your parents or grandparents will secure your mortgage against their home or put their money into a fixed-term account. Be aware that your family member’s cash, or property is at risk. Talk to a mortgage broker to find out what these deals involved and whether you are eligible.

Government schemes

There has been a high level of demand for homes since the property market re-opened last year due to pent up demand, the stamp duty holiday, low interest rates and a reassessment of buyer’s requirements. Last year buyers faced having to raise deposits of around 20% in order to secure a loan and this was against a backdrop of house prices increasing and, as a result, a substantial number of first time buyers have had to put their plans on hold. This scheme means that those with a small deposit can now realise their dream of getting onto the property ladder.

Although Help to Buy (Scotland) and the First Home Fund have now ended, the government backed ‘Mortgage Guarantee Scheme’ came into effect from April this year. The scheme aims to help buyers with a 5% deposit. Under the scheme, buyers can purchase a property priced up to £600,000 and it is open to everyone, not just those who are buying their first home and never had a mortgage before – as was the limitation for the Help to Buy Scheme. This means that the scheme will help both first-time buyers as well as those looking to move up the property ladder.

Buyer incentives

House builders often have incentives such as free fixtures and fittings, stamp duty bills and legal fees.

Pool resources with friends or family

One of the most common ways to purchase a property is to pool resources with friends, a partner or family. The ‘bank of mum and dad’ is increasingly popular but whoever you are committing to buying a home with, you need to think about what will happen if one party wants to sell or if they are unable to meet their share of the mortgage repayments. If you borrow you as borrowers are ‘jointly and severally liable,’ the lender can chase either of you for missed payments.

Buy at a fixed price

With house prices rising since the housing market reopened at the end of June at an unprecedented rate – due to the stamp duty holiday and a re-evaluation of buyers’ priorities – buying at a fixed price means you aren’t being priced out of the market. The price you see is the price you pay with no closing dates, offers over or paying over the odds due to high competition for the same property.

Reassess your wish-list

Lenders are becoming increasingly tough on what they will lend, resulting in stricter criteria for calculating what you can borrow, based on your income and expenditure. Some lenders are offering 4.5 times your salary instead of 5.5 previously which impacts what you can afford to buy. With this in mind it may be worth reconsidering where you want to live and the sort of home you want to buy. Do you need to live near public transport and travel links, could you purchase a new build home to make it more cost efficient and do you need an extra bedroom?

Credit rating

It’s important that you have a good credit score in order to obtain a good rate on your mortgage – the lower the score the lower risk you are considered to be by the lender. Check your credit score before you look to buy a property to give you time to improve this.

A larger deposit

If you can cobble together a little more savings to put towards the cost of your mortgage it will keep your outgoings down and open up more mortgage options. Some lenders are offering 10% mortgages aimed at borrowers in the local area and for those in particular professions. Ideally you want to have 15% deposit to get the best possible deal.

Talk to us at Urban Union if you’re looking for your first home. Our properties can be reserved with a small reservation fee and are available at a fixed price in our Glasgow and Edinburgh developments.

A New Way of Living and Working

Following the pandemic there has been a shift in how people feel about their home, and this has had a profound effect on the property market in the UK.

The lockdowns we have all experienced since March 2020 and the subsequent changing restrictions has caused people to re-evaluate what they want (and need) from their homes. Features that people previously didn’t place importance on suddenly became a priority. Gardens, a balcony, roof terrace, proximity to green spaces and a place to work or study all became must-have features.

According to a survey by Zoopla, despite working from home being the e norm for most people last year, 20% weren’t happy with their working set up. In addition, only 23% of those we surveyed had a dedicated study or workspace, with 18% working in their living room and a further 14% working in their bedrooms.

Lack of space was the biggest issue for homeowners and renters, with nearly a fifth of respondents complaining about being forced to share their workspace with a spouse, family member or housemate and 8% felt the lack of privacy for calls and virtual meetings was impacting on their work.

Open plan living has always been a popular feature of a home as people return from an office or work space and want to feel that the space in their home is maximised and allows for more sociable living. Since the pandemic 30% of people said their views on open plan layouts had changed, with 11% saying they did not think they were practical and 33% believing it wasn’t a good idea in the first place.

However, 17% of those surveyed said they now preferred the idea of open plan living – this could be because they felt cut off not being in an office environment.

Houses have been in high demand from those looking to move leading to a rise in house prices for homes with 3+ bedrooms and outside space.

Going forward, recent research from Deloitte found that 60% of people who don’t normally work from home will be doing so more often going forward and the Bank of England Chief Economist predict that 50% of all office-based staff will be working from home full or part time, compared to 5% before the pandemic.

If you are looking for a property with space, light, access to communal areas or with a balcony or garden, take a look at our developments with properties available at affordable prices, in regenerated communities and close to city hubs.